Wed, May 7, 2025

The Federal Reserve is widely expected to hold interest rates steady at the conclusion of its policy meeting Wednesday, but the path forward is anything but certain for Jerome Powell.

Investors will be listening closely to the central bank chairman at a 2:30 p.m. ET press conference for any hints on future monetary policy actions after President Trump spent the last few weeks repeatedly calling for the Fed to lower rates while also lobbing insults at Powell.

Trump in recent weeks referred to Powell as a "major loser," "Mr. Too Late," and a "total stiff" in a series of social media posts. He also said that Powell's "termination can't come fast enough" before later clarifying that he had no intention of removing Powell before the end of his term in May 2026.

Powell and his colleagues expect to be grappling in the months to come with a vexing dilemma. They likely will need to decide which side of their dual mandate to emphasize — price stability or maximum employment — as Trump's tariffs potentially push inflation higher and possibly act as a drag on economic growth.

Powell last month made it clear he would wait for more clarity before deciding. Some Fed watchers expect him to do the same today.

"We expect the main message from Chair Powell’s press conference to be that the [Federal Open Market Committee] is well positioned to wait for greater clarity before making any changes to policy," JPMorgan chief economist Michael Feroli said.

New reports on the economy, jobs, and inflation released last week reinforced the Fed's conundrum as it looks for patterns in the data.

A GDP report showed the US economy contracted for the first time in three years to begin 2025 due largely to a rush by importers to beat the start of Trump's tariffs.

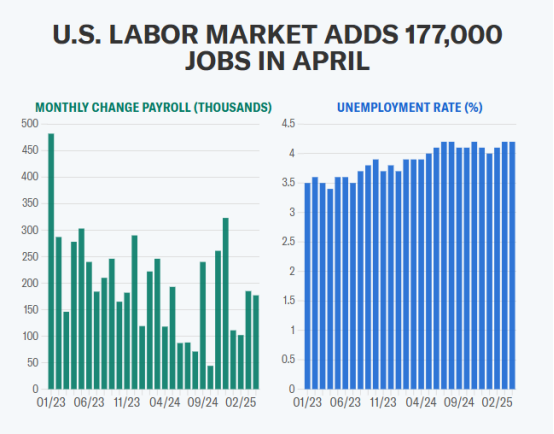

But an April jobs report released last Friday also showed the labor market remained resilient even in the weeks after Trump's "Liberation Day" announcements shook markets.

"We fear, unfortunately, that the near-perfect jobs report in April shows the economy as it could have been in the absence of a tariff shock, and it may mislead policymakers into believing the economy is more resilient than it truly is," EY chief economist Gregory Daco said.

As for inflation, a gauge favored by the Fed released last week showed that price growth slowed in March to an annualized 2.6%, but it was still a hotter-than-expected 3.5% for the entire first quarter.

And both marks are above the Fed's target of 2%.